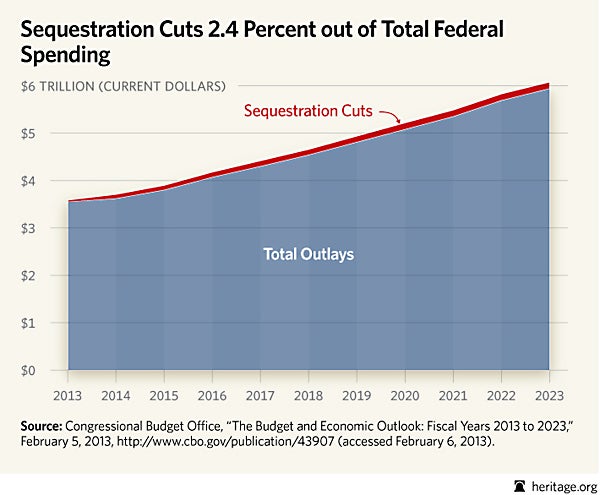

Federal spending will explode from $3.6 trillion to $6 trillion over the next 10 years, but the much-maligned sequester will cut only 2.4 percent of this spending.

Sequestration represents a relatively small cut in projected spending. So why are so many in Washington wringing their hands over a two-and-a-half percent reduction?

Because sequestration leaves the largest component of federal spending—entitlements—nearly untouched. Instead, it falls most heavily on national defense, with 50 percent of sequestration cuts impacting national security. Thirty-five percent would impact non-defense discretionary spending. Less than 15 percent would fall on mandatory spending, which consumes 62 percent of the federal budget.

Not one of these cuts will address the dominant underlying cause of growth in government spending: entitlements.

Medicare, Medicaid, and Social Security together drain 44 percent of the budget each year—and their share of spending is growing. By midcentury, these programs and Obamacare together will gobble up all of America’s historical tax revenue, leaving everything else—defense, federal law enforcement, transportation, and veteran care, etc.—to be financed on federal borrowing. But sequestration fails to curb this growth in spending.

Tax increases are no solution. President Obama already grabbed $618 billion in tax increases. These tax hikes harmed opportunity for Americans by increasing taxes on investors and job creators, and yet the budget remains out of balance. Washington has a spending problem—not a revenue problem—and only spending cuts can put the budget on a path to balance.

Spending cuts from sequestration and more are necessary. Without them, Americans will suffer even more in the future as economic uncertainty undermines opportunity and as deficits become growth-reducing debt. The good news is that there are smart ways to cut spending to offset sequestration, and at least six bipartisan ways to reform entitlements.

For example, as Heritage experts J. D. Foster and Alison Acosta Fraser write, Congress could:

- Correct the cost-of-living adjustment (COLA) for Social Security;

- Raise the Social Security eligibility age to match increases in longevity; and

- Raise the Medicare eligibility age to match Social Security.

There are many ways to save money now, too. Congress could cut:

- The Lifeline program. This program spent $2.2 billion to provide telephones and service to low-income individuals. As Heritage expert Patrick Louis Knudsen writes, “Remarkably, 41 percent of ‘customers’ receiving taxpayer-subsidized service from the top five carriers failed to verify their eligibility, according to the Federal Communications Commission.”

- Community Development Block Grants. Many of the $3 billion in grants from this program go to economically well-off communities that don’t need them.

- The Job Corps. According to Knudsen, this is $1.7 billion spent on “a demonstrably ineffective program that has failed to match many of its trainees with the jobs they were trained for.”

These are a few suggestions for how to reduce government spending now and correct the drivers in spending growth into the future. Ordinary citizens will see even more economic growth–reducing debt unless Congress reins in federal spending. Instead of panicking over the 2.4 percent cut that is sequestration, lawmakers should tackle entitlement reform and cut other spending to balance the budget in 10 years.