“Would raising taxes on the wealthiest Americans have a chilling effect on hiring in this country?” When asked this question by Today’s Matt Lauer, Warren Buffett confidently answered, “No.” How could this be, when the tax hikes desired by President Obama would fall directly on some of America’s most successful job creators?

As Kris Roglieri wrote in The Washington Post:

What policymakers fail to realize is that most small business owners, who also employ most of the country’s workforce, declare their business profits on the owner’s personal income tax return and are taxed at the personal income tax rate. Given that the net income number for many will be over $250,000, the proposed tax hikes could have a dramatic effect on small businesses and the growth and hiring decisions they will make. Another point policymakers overlook is that business owners will ultimately pass this cost on to the middle class by raising prices on goods and services, possibly triggering layoffs and stalling hiring.

Professor George Haynes of Montana State University analyzed small business employment based on the Federal Reserve Survey of Consumer Finances and found that those small businesses run by families earning more than $250,000 per year employ 93 percent of the people working in small businesses. Raising these businesses’ taxes means that they have fewer resources available to invest and create jobs.

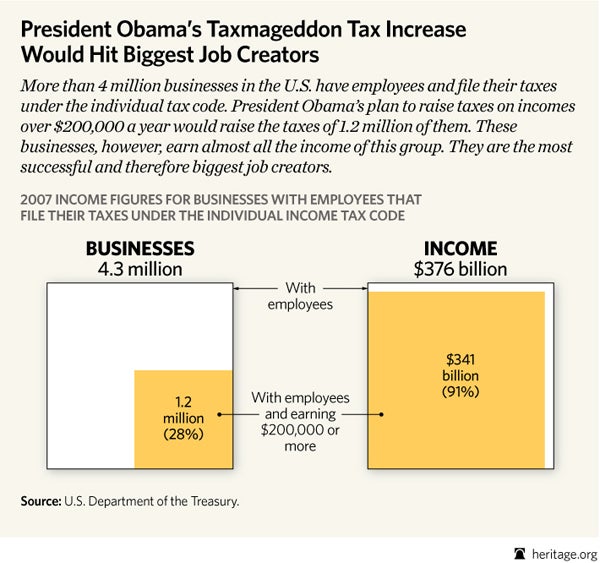

Based on data from the President’s own Treasury Department, tax hikes on upper-income earners would directly fall on 91 percent of income earned by job-creating businesses that pay their taxes through the individual income tax, which are known as flow-through businesses. (continues below chart)

Successful small businesses face a double whammy from the Obama tax hikes. In addition to allowing the Bush tax cuts to expire for wealthy Americans, President Obama’s signature health care law will raise their taxes yet further. As Heritage’s Curtis Dubay explains:

The higher tax rate on wages and salaries will cause workers to cut back on their hours, which will slow economic growth. It will also deter job creation at small businesses. The income of certain small businesses (sole proprietorships) is wage and salary income to the owner. As both employee and employer, the owner therefore pays the entire newly increased 3.8 percent [hospital insurance] tax rate. With more of the owner’s—and therefore the business’s—income taken by higher taxes, the owner will have fewer resources to invest back into the business to create jobs.

The answer to whether raising taxes on upper-income Americans would chill hiring is an emphatic yes—especially because those taxes fall on some of the nation’s biggest job creators. Lawmakers should avoid tax hikes on all Americans—no matter what Warren Buffett and other supporters of higher taxes would have you believe.