Several key questions still remain to be asked of President Obama and Governor Mitt Romney during tonight’s debate. Among them: What would each of them do to reduce the growing burden of federal spending on American households?

In 2012, the federal government spent $29,700 per American household. Of that amount, $9,400 was deficit spending. Put another way, $3.20 out of every $10 spent was borrowed.

These facts and more are available in a new Heritage report: “Federal Spending by the Numbers 2012.”

In 20 powerful graphics and four detailed tables, “Federal Spending by the Numbers 2012” analyzes government spending trends in the past and future. Heritage experts explain where the federal government spends the most, which areas of the budget have grown the fastest, and when the entitlements and net interest begin to overwhelm all other federal spending. Specific examples of government waste are featured at the end.

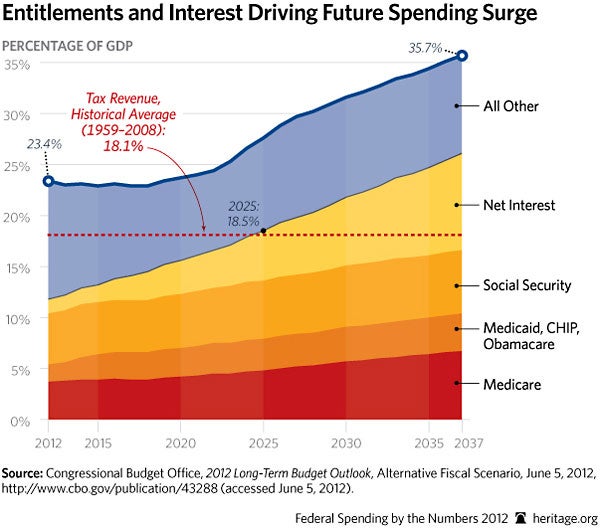

By 2025, the major entitlements and net interest will grow to 18.5 percent of gross domestic product (GDP), devouring all tax revenue at the historical average level. (continues below chart)

Net interest is already the fifth-largest budget category today—after Social Security, national defense, and federal health care spending such as Medicare and Medicaid. This is especially alarming because interest rates are at historical lows. Were interest rates to increase, this situation would dramatically worsen.

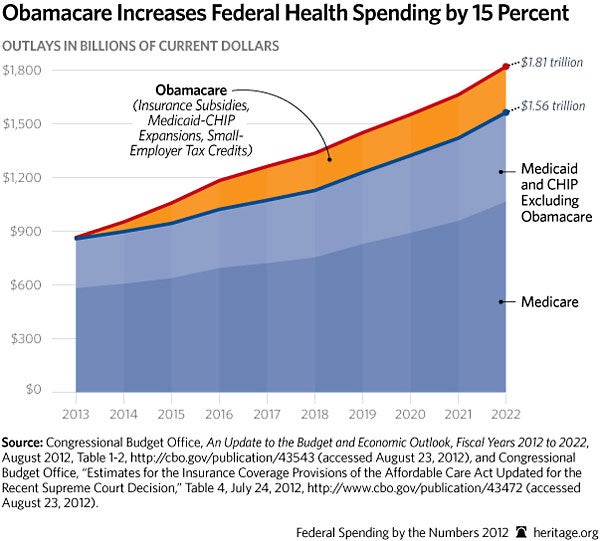

Medicare is the fastest-growing major entitlement, ballooning by 68 percent in just 10 years, from $285 billion in 2002 to $478 billion in 2012. (continues below chart)

Obamacare’s $1.7 trillion in new spending will increase federal health care spending by 15 percent. This will bring total government health care spending (including state and local) to more than 50 percent of all health care spending in the U.S. in less than 10 years. (continues below chart)

Federal health care is also the area most prone to government waste. As described in the Heritage report:

In 2011, the federal government wasted $115.3 billion of taxpayers’ money in improper payments: money paid in the wrong amount, to the wrong person, or for the wrong reason. Most of these excess payments—$107 billion, or 93 percent—were in just 10 programs, including Medicare fee-for-service ($28.8 billion) [and] Medicaid ($21.9 billion).

Find all these facts, charts, and more, in “Federal Spending by the Numbers 2012.”