The Tax Policy Center (TPC) made headlines with its analysis of Governor Mitt Romney’s tax reform plan. The authors of the TPC report found, incorrectly as it turns out, that Romney’s plan would “necessitate” a tax increase on middle- and low-income taxpayers.

Their conclusion is wrong and the report flawed because the authors made a series of assumptions and choices that lead them to their carefully selected result.

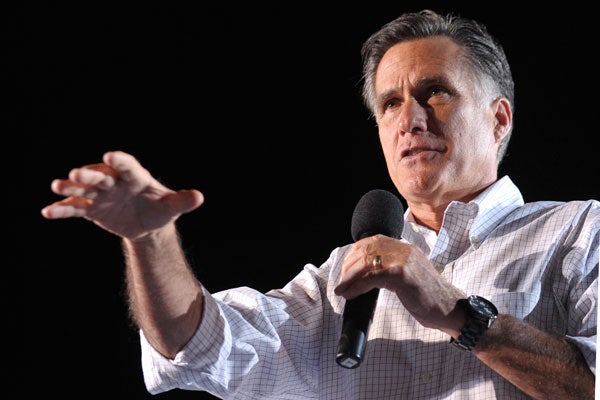

Romney’s plan does what most sensible tax reform plans do to increase incentives to engage in the activities that create economic growth: It cuts marginal tax rates and reduces the tax bias on saving and investment.

The Romney plan offsets the revenue lost from those improvements by broadening the tax base (i.e., eliminating credits, deductions, exemptions, and exclusions, otherwise known as “tax preferences”) in unspecified ways. And it makes these changes without shifting the share of taxes paid by various income groups.

The TPC authors chose to frame their analysis on the hot-button issue of tax distribution by ignoring the fact that Romney’s plan doesn’t shift the tax burden. They could’ve chosen to analyze all the aspects of the Romney plan. Instead, though the Romney plan doesn’t specify, the TPC authors chose which tax preferences they thought the plan would eliminate.

Importantly, they “took off the table” (their words) several tax preferences that mostly benefit upper-income taxpayers. Then they analyzed how the Romney plan’s pro-growth changes would affect tax distribution after closing their selected tax preferences.

However, changing the assumptions the TPC authors made leads to a different conclusion. Governor Romney’s tax plan can make pro-growth changes to taxes without raising taxes on middle- and low-income taxpayers.

Tax reform is an issue vital to the economy’s revitalization. Until Washington overhauls the tax code to lower rates and make other growth-oriented changes to the tax code, the economy will not recover as strongly as it should.

For politicians and the public to make the right decisions about tax reform, they need accurate information. To help advance the debate, instead of weighing it down with flawed analysis, the TPC authors should show how Governor Romney’s plan doesn’t have to raise taxes on middle- and low-income taxpayers. They could further advance the debate with a discussion of the benefits the Romney plan would have for economic growth.

3 Replies to “Romney’s Tax Plan Doesn’t Have to Raise Taxes on the Middle Class”