President Obama has made raising taxes on “the rich” a central plank of his re-election campaign. Yet even many Democrats are questioning the wisdom of hiking taxing on job creators while the economy is still struggling and unemployment is still lingering at over 8 percent.

They are right to be concerned. According to calculations by The Heritage Foundation’s Center for Data Analysis (CDA), the average American with $250,000 or more in income can expect an average $24,888 tax increase next year under Obama’s proposed policies.

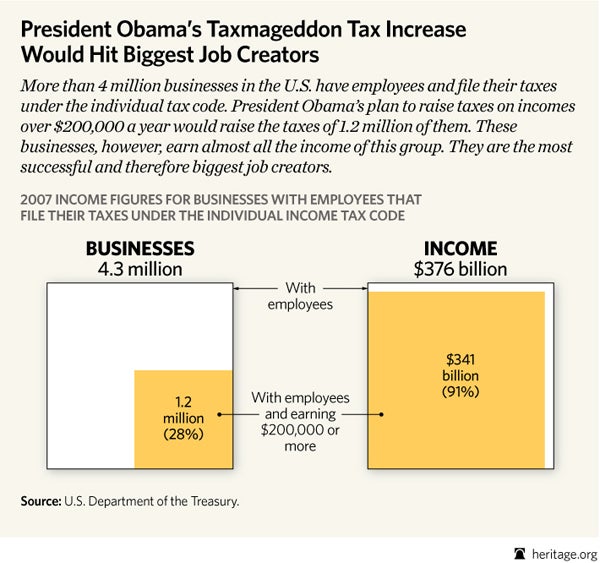

The $24,888 figure is often enough for a salary, and despite what some proponents of the tax hike have argued, many of these successful small businesses do have employees. According to the Treasury Department, 1.2 million small businesses both had employees and earned more than $200,000 in 2007. So the President is putting about 1.2 million jobs—perhaps even more—at risk with this tax hike.

In 2014, there will be about 1.9 million taxpayers with purely non-farm business gains of more than $250,000, according to the same CDA analysis. In other words, almost 2 million tax filers will have at least $250,000 of just business income—not counting any wages, capital gains, or rental income. This business income could be used to hire new employees or at least stay in business and keep them employed.

If President Obama’s tax hikes are put in place, each of these taxpayers will have to hand over about $25,000 more of that business income to Uncle Sam instead. Small businesses already have to compete with corporations, which are favored by regulatory policy and the tax code and even propped up with stimulus money. Small businesses, which are the real engine of job growth in America, simply cannot afford yet another hit.

For more, see Curtis Dubay’s analysis on how the proposed tax increases would affect small business.

23 Replies to “Obama’s Small-Business Tax Could Average $25,000”