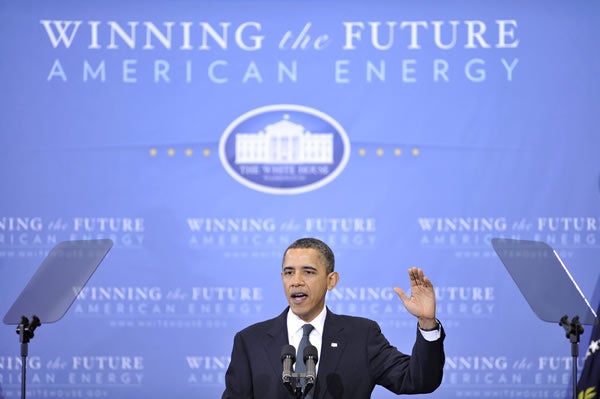

President Obama pushed for expanding wind energy and advanced energy manufacturing subsidies at the wind turbine manufacturer TPI Composites in Newton, Iowa, today.

President Obama pushed for expanding wind energy and advanced energy manufacturing subsidies at the wind turbine manufacturer TPI Composites in Newton, Iowa, today.

These subsidies have and continue to enjoy bipartisan support precisely because they benefit both Republicans and Democrats come election time, when they can say they helped create jobs for their district and state. But targeted tax credits and other subsidies are wasteful and economically destructive for four fundamental reasons:

- Subsidies destroy jobs elsewhere. If you subsidize anything enough, you’re bound to find producers to take advantage of that subsidy to create jobs. Taxpayer-funded programs do not create jobs; they shift them from one sector of the economy to another. The opportunity cost of government spending is the lost labor and capital extracted from other sectors (ones that do not need government support) of the economy to artificially support the politically preferred ones. Subsidizing inefficient technologies is an economic drain, not an economic stimulator.

- Subsidies promote crony capitalism. When the government dictates how private-sector resources are spent by issuing subsidies and targeted tax breaks, those industries that benefit greatly from such policy decisions will spend more money lobbying for government handouts. In fact, TPI Composites was a recipient of stimulus money. This is also a company that received $66 million in private financing over the past five years. If that’s the case, why should the taxpayers be on the hook for $9 million worth of investment? Further, European countries, recognizing that green subsidies have been ineffective in promoting economic growth but very effective in growing its national debt, are peeling back their subsidies. Many foreign-owned companies are looking to take advantage of American subsidies now. Foreign companies from Germany, the U.K., and Spain attended a recent White House meeting on renewable tax credits. While it’s unabashedly welcome that foreign companies invest in the United States, this goes to show that the lure of taxpayer-funded handouts attract domestic and foreign rent seekers.

- Subsidies create industry dependence on government. One common justification for subsidizing technologies is that the technology or industry just needs a five-year window of handouts before it will become commercially viable on its own. Going on the fifth year, supportive politicians and industry come back pleading for five more years and arguing that we need “certainty” for these businesses. You’re hearing it again this time. Senator Pat Roberts (R–KS) recently said, “I think it’s a crucial thing it’s at least extended so they know where they are.” These industries do know where they are. It’s plain and simple: The PTC expires at the end of the year. Government subsidies create this dependence and remove the incentive for companies to make their technologies cost-competitive. Eliminating the subsidies would allow companies to truly realize the price point for which their technologies can enter the marketplace. If that price point is too high, then it doesn’t belong in the marketplace.

- Subsidies waste taxpayer dollars. Whether or not a company is successful, energy subsidies are a wastefully poor use of taxpayer dollars. This is the case whether government is subsidizing losers that couldn’t get private financing for a reason or offsetting private sector investment with taxpayer financing. This has been true with companies that are now bankrupt (Beacon, Ener1, Evergreen, Raser Technologies, Solar Trust for America, Solyndra and SpectraWatt) and ones that are in financial distress (A123 Systems, Abound Solar, First Solar, Nevada Geothermal, SunPower, and U.S. Geothermal). Even if a project with a taxpayer-funded subsidy is successful, attributing the project’s success to the taxpayer support is a huge assumption. It merely offsets the private-sector investment that would have been made anyway. Venture capitalists and other investors, who have much more expertise and knowledge than government bureaucrats in making investment decisions, should be making these choices.

Removing the targeted tax credits for all energy sources and broadly lowering the tax rate, as legislation by Representative Mike Pompeo (R–KS) and Senator Jim DeMint (R–SC) does, would create a more market-based energy economy that benefits economically viable producers and, ultimately, consumers.