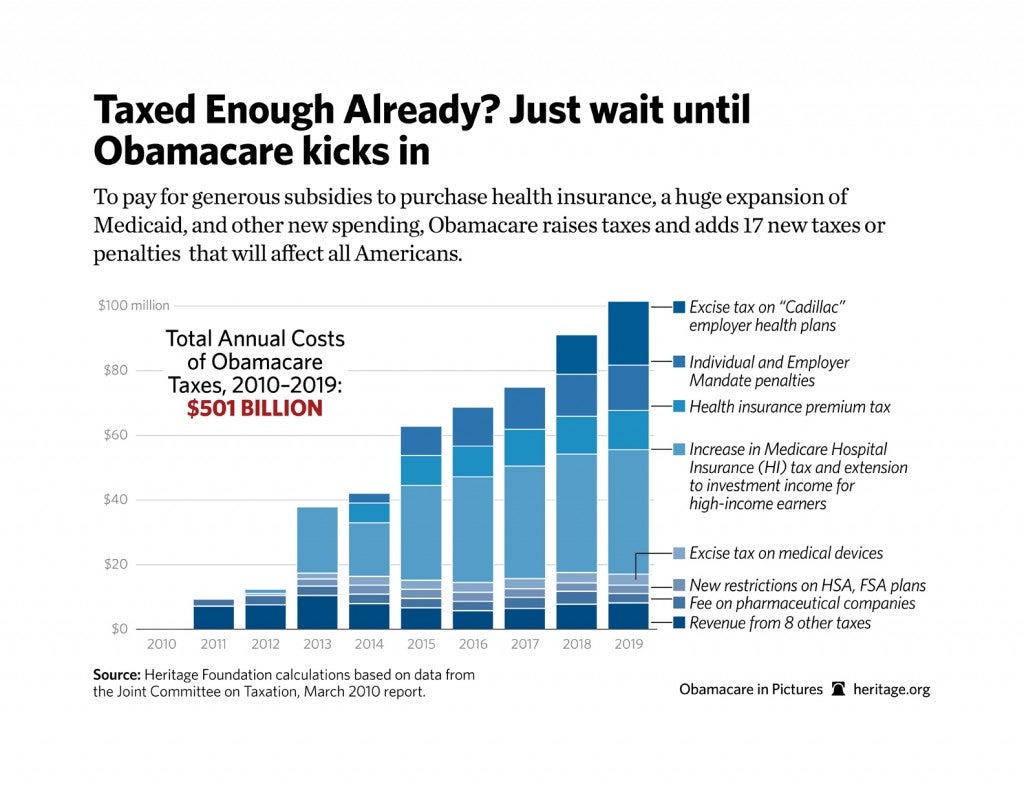

Yesterday was tax day, serving as a special reminder of how big the federal government has become. As Heritage has warned before, Obamacare is on track to makes things a lot worse.

The President’s health law will be partially paid for by tax increases and the creation of new taxes. When Obamacare first passed, the Joint Committee on Taxation estimated that its tax hikes would total $502 billion over the next 10 years. But most of the new, higher taxes don’t kick in until later in the decade, which means that once all of the law is fully implemented, the taxpayers’ tab will be much bigger than originally estimated.

A new study by the Joint Economic Committee (JEC) revealed today that Obamacare will impose higher taxes totaling $4 trillion between now and 2035, with substantial hits on working Americans. That works out to more than $1.7 trillion over a decade—more than triple the original 10-year score.

Below is a list of 10 of Obamacare’s most costly taxes and fees, drawn from research by Heritage tax policy expert Curtis Dubay:

1. Hospital Insurance Tax. Beginning in 2013, Obamacare increases the Hospital Insurance (HI) portion of the payroll tax from 2.9 percent to 3.8 percent for families earning more than $250,000 a year and for single filers earning more than $200,000 annually. The increased HI tax is also applied to investment income for the first time. The 3.8 percent surtax on investment income is the most economically damaging tax in Obamacare. And these tax increases won’t remain just on families making more than $250,000 a year for long. As the JEC explains, this tax is not indexed to inflation: “This means that in just 10 years from now, the so-called ‘high-income’ thresholds will have effectively ratcheted down to $152,000 and $190,000 in today’s dollars.” This tax increase amounts to $210 billion between 2013 and 2019.

2. Mandate Penalties. In 2014, Obamacare’s individual and employer mandates go into effect, forcing individuals to purchase coverage and employers to offer coverage to their workers. The penalties paid in association with these mandates are an estimated $65 billion between 2014 and 2019.

3. Health Insurance Provider Fee. Starting in 2014, Obamacare imposes an annual fee on health insurance providers based on each company’s share of the total market. This totals a $60 billion tax hike between 2014 and 2019.

4. “Cadillac” Tax. In 2018, Obamacare puts a new 40 percent excise tax on “Cadillac” health plans, meaning plans that cost more than $10,200 for an individual and $27,500 for families. However, this tax is not indexed to medical inflation, causing it to eventually tax “Honda” plans at this rate as well. The JEC points out that “[t]he bulk of revenues from the ‘Cadillac’ tax would not be paid by platinum health insurance plans, but rather by employees who are forced to exchange tax-free health insurance benefits for taxable wages after employers reduce or eliminate health insurance.” This tax amounts to $32 billion in higher taxes in the first two years of its implementation.

5. Prescription Drug Fees. Since 2011, Obamacare has put an annual fee on manufacturers and importers of branded drugs based on each individual company’s share of the total market. Between 2011 and 2019, this will amount to a $27 billion tax increase.

6. Ethanol Tax. In 2010, Obamacare excluded ethanol from the existing cellulosic biofuel producer tax credit. This will hike taxes $24 billion from 2010–2019.

7. Medical Device Tax. Beginning in 2013, Obamacare imposes a 2.3 percent excise tax on medical device manufacturers. This will raise taxes on patients needing medical devices, who will ultimately pay the tax through higher prices, by $20 billion from 2013 to 2019.

8. Business Regulation Costs. Beginning in 2012, Obamacare raises corporate taxes through stricter enforcement, because businesses will be required to report more information on their business activities. This will raise taxes $17 billion from 2012 to 2019.

9. Reducing Medical Deductions. In 2013, Obamacare raises the floor on itemized medical deductions from 7.5 percent of adjusted gross income to 10 percent, meaning Americans must spend 2.5 percent more of their income before they get a medical deduction, costing $15 billion from 2013 to 2019.

10. FSA Limits. Starting in 2014, Obamacare limits the amount of pre-tax dollars that taxpayers can deposit in flexible savings accounts (FSAs) to $2,500 a year. This results in an extra $13 billion in taxes from 2014 to 2019.

These are only 10 of Obamacare’s 18 tax increases. The economic damage from these tax hikes is one of many reasons Congress needs to repeal Obamacare and start from scratch to properly reform the health care system.

To learn about all of Obamacare’s taxes, read Obamacare and New Taxes: Destroying Jobs and the Economy.

42 Replies to “Top 10 Most Expensive Obamacare Taxes and Fees”