This April Fool’s Day, the joke is on all of us. That’s because as of April 1, the U.S. now has the highest corporate tax rate in the developed world.

Our high corporate tax rate has long made the U.S. an uncompetitive place for new investment. This has driven new jobs to other, more competitive nations and meant fewer jobs and lower wages for all Americans.

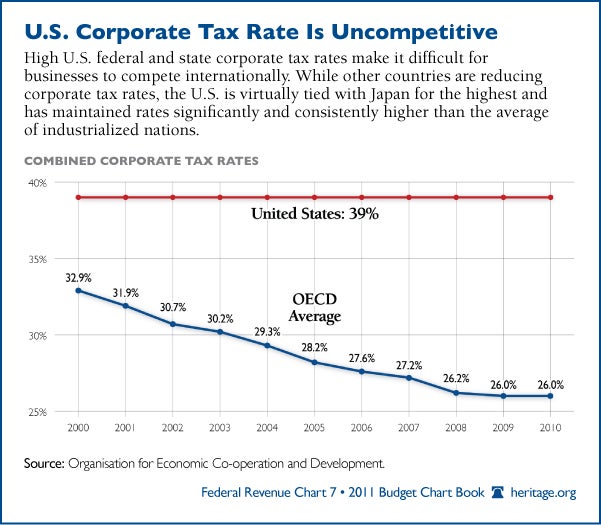

Other developed nations have been cutting their rates for over 20 years. The U.S. did nothing.

The U.S. was at least able to stay out of the top spot until now, because Japan had also failed to get its corporate tax rate in line with other more competitive nations. But Japan has finally seen the light and reduced its rate as of April 1.

Japan’s rate was 39.5 percent. That was just barely ahead of the U.S. rate of 39.2 percent (this includes the 35 percent federal rate plus the average rate the states add on). Japan’s rate now stands at 36.8 percent after its recent cut.

The U.S. rate is well above the 25 percent average of other developed nations in the Organization for Economic Cooperation and Development (OECD). In fact, the U.S. rate is almost 15 percentage points higher than the OECD average.

This gaping disparity means every other country that we compete with for new investment is better situated to land that new investment and the jobs that come with it, because the after-tax return from that investment promises to be higher in those lower-taxed nations.

Our high rate also makes our businesses prime targets for takeovers by businesses headquartered in foreign countries, because their worldwide profits are no longer subject to the highest-in-the-world U.S. corporate tax rate. Until Congress cuts the rate, more and more iconic U.S. businesses such as Anheuser-Busch (which was bought by its Belgian competitor InBev in 2008) will be bought by their foreign competitors.

To get back in line with international norms, Congress needs to reduce the rate so the combined federal and state rate matches or falls below the OECD average. Some will contend that with deficits north of $1 trillion annually, we simply can’t afford such a large rate reduction. But the actions of the nations we compete with for new investment show that these nations understand that lowering the corporate tax rate is necessary because of the boost to economic growth it provides.

The United Kingdom, for instance, is in as perilous fiscal situation as the U.S. However, the U.K. reduced its rate in 2011 from 28 percent to 26 percent. Chancellor of the Exchequer George Osborne recently announced that the U.K. would further cut its rate to 22 percent by 2014 to increase competitiveness.

Congress needs to cut the corporate tax rate to make the U.S. a more hospitable place for investment. The time for excuses is over. Until it does, every day will be a cruel joke.

28 Replies to “No Fooling: U.S. Now Has Highest Corporate Tax Rate in the World”