After Massive Losses, Stimulus-Backed Company Asks for More Taxpayer Cash

Lachlan Markay /

A financially troubled green energy company has seen its stock prices plummet to below a dollar per share (UPDATE: see below) since receiving a nearly $250 million federal grant in 2009. The company lost $257.7 million last year. Two of its clients make up half of its business, and one is also struggling financially.

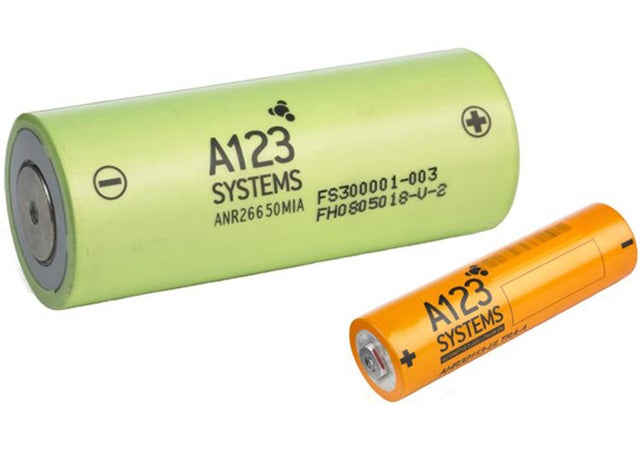

But none of that has stopped A123 Systems, which manufactures batteries for electric vehicles, from applying for another $233 million in federal backing through the Energy Department’s Advanced Technology Vehicle Manufacturing program, according to its latest filing with the Securities and Exchange Commission.

“We have made a loan application under the Advanced Technology Vehicles Manufacturing Loan Program, or the ATVM Program, to support our continued manufacturing expansion,” A123 said in the SEC filing. “Based on the amount of our grant award under the DOE Battery Initiative and the guidelines associated with the ATVM Program, we believe we will be permitted to borrow up to $233 million under the ATVM Program.”

It is not clear that the Energy Department will approve the request. The rule establishing the ATVM program dictates that loan recipients must be “financially viable without the receipt of additional Federal funding associated with the proposed project.”

Whether A123 meets that qualification is questionable. “Much of our planned domestic manufacturing capacity expansion depends on receipt of these funds [from the ATVM program] and other incentives,” the company stated in its SEC filing, “and the failure to obtain these funds or other incentives could materially and adversely affect our ability to expand our manufacturing capacity and meet planned production levels.”

The Energy Department did not return multiple requests for comment on A123’s loan application. [UPDATE: In an email Friday afternoon, DOE spokesman Bill Gibbons said that the Department could not comment on pending loan applications.]

Even if the company is eligible for the loan, however, it is in dire financial straits, and may be a shaky bet for an administration already plagued by a series of Solyndra-esque green energy flops.

According to its SEC filing, A123 is relying not only on further federal funding, but on its two largest clients, which together account for half of its business. One of those companies, Fisker Automotive, is also financially troubled.

“For the year ended December 31, 2011,” its filing states, “revenue from our two largest customers, Fisker and AES Energy Storage, LLC and its affiliates, or AES, represented 26% and 24% of our revenue, respectively.”

Fisker, which received a $529 million loan through the ATVM program despite conducting significant portions of its operations in Finland, delayed production of one of its models, and was forced to lay off 65 employees. A pair of U.S. senators is investigating DOE’s decision to award its Fisker loan.

The 26 percent of A123’s revenue coming from its relationship with Fisker increased by 1,300% percent since 2010. “If Fisker is unable to fulfill its commitment under the supply agreement,” A123 states, “our revenues could be materially lower than our forecasts and we may have under-utilized manufacturing capacity.”

A123 even cites a shortfall in orders from Fisker as a cause of its declining financial health in 2011. “In November 2011 and again in January 2012, we announced revised annual revenue guidance for 2011 due to an unanticipated reduction in orders from Fisker for the fourth quarter,” the SEC filing states.

Ali Meyer contributed to this report.

(UPDATE: A123 shares rose above a dollar on the news that the company would be awarded a sizable Army contract. Developing…)