Payday Lenders Accuse Obama Administration of Last-Ditch Effort With Operation Choke Point

Kelsey Bolar /

Short-term lenders say the Obama administration is attempting a last-ditch effort to use Operation Choke Point to crack down on their industries, causing an “urgent” situation where businesses are unable to perform basic functions like pay their employees.

After losing dozens of more banking relationships in recent weeks, a group of payday lenders asked a federal judge in the District of Columbia for emergency relief from the government program, which has been criticized for improperly targeting legitimate businesses.

“The need for immediate relief is more urgent than ever,” said Dennis Shaul, CEO of Community Financial Services Association of America (CFSA), a trade association that represents approximately 9,000 short-term brick-and-mortar lenders. “Without an injunction against Operation Choke Point, I firmly believe some CFSA members will be forced to curtail their operations dramatically and others will have to shut down altogether.”

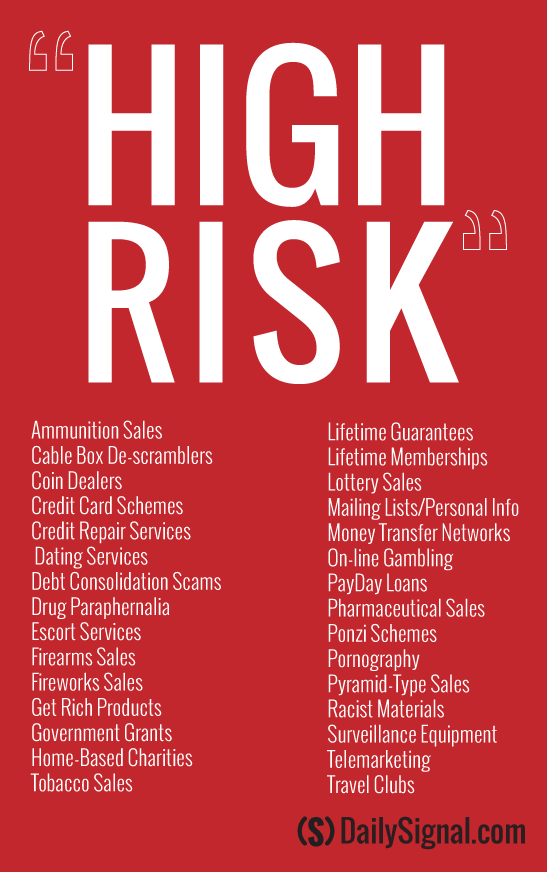

Operation Choke Point was designed by the Justice Department in 2012 to “attack internet, telemarketing, mail, and other mass market fraud against consumers, by choking fraudsters’ access to the banking system,” according to the Justice Department’s proposal for the program.

By teaming up with federal regulators—including the Federal Deposit Insurance Corp., the Federal Reserve, and the Office of the Comptroller of the Currency—the Justice Department believed it could crack down on fraud by using federal regulators to pressure banks out of providing services to fraudulent businesses.

But critics of the program, including many Republicans in Congress, say it was used to put the financial squeeze on legal industries the Obama administration doesn’t like, such as firearms sellers and payday lenders.

The Daily Signal contacted the Justice Department for an update on the current status of the program, but a spokesperson did not respond.

In April, one of President Barack Obama’s former top Justice Department officials behind the program detailed how Operation Choke Point has had “unintended but collateral consequences” on banks and U.S. consumers.

Since then, the complaints about the program hurting legal business owners haven’t stopped.

‘A Shadow Campaign’

“Operation Choke Point is a shadow campaign against law-abiding businesses,” said Jamie Fulmer, a spokesman for Advance America, the largest payday lending company in the country. “Regulators are using backdoor tactics to eliminate short-term lending.”

Advance America and the CFSA are co-plaintiffs in a 2014 lawsuit filed against the Federal Deposit Insurance Corp., the Federal Reserve, and the Office of the Comptroller of the Currency for their roles in Operation Choke Point.

Christian Rudolph, chief financial officer for Advance America, said in court documents that since 2013, at least 21 banks sent the company termination notifications.

“Recently,” he said when requesting an emergency injunction against the Obama administration’s program, “these bank terminations have reached a tipping point and begun to threaten to significantly curtail Advance America’s ability to conduct its business operations. Advance America is on the verge of effectively being denied its right to hold a bank account.”

Payday loans are small-dollar, two-week loans, meant to be paid back when customers receive their next paycheck. The typical fee charged by payday lenders is $15 per $100 borrowed.

Critics of the industry worry that borrowers will struggle to repay the loans, which will spiral into higher fees, leaving customers in a cycle of debt. But supporters say the industry provides a much-needed service to Americans who are in a financial bind, or lack access to a bank. They also argue the costs of using bounced checks or paying late fees on a credit card are even higher.

The case, CFSA et al. v. Federal Deposit Insurance Corp., is still ongoing, and last year, the court green-lighted it to move forward on the grounds that the federal government may have violated the due process clause of the Fifth Amendment.

Under this clause, lawyers for CFSA argue in court documents the stigma that the government established against their industry under Operation Choke Point has “deprived them of their rights to bank accounts and their chosen line of business.”

Since the program took off in 2013, it was not unusual to hear victims speak out about the negative effects Operation Choke Point was having on small businesses. The Daily Signal has documented many of these accounts.

However, bank officials were notably mum, declining to affirm or deny theories that federal regulators were the reason they were terminating relationships with entire lines of business.

Last Wednesday, however, when Advance America and the CFSA asked a judge for emergency relief from the program, lawyers included a written statement from Ed Lette, chairman of the Business Bank of Texas.

Lette outlined how federal regulators from the Office of the Comptroller of the Currency forced him to end a mutually beneficial, long-standing relationship with Power Finance Texas, a Texas-based payday lender.

“Business Bank of Texas was forced to end this long-standing and beneficial relationship with Power Finance Texas by the Office of the Comptroller of the Currency,” Lette writes, adding:

During a recent meeting with Scott Ward, an assistant deputy comptroller in the [Office of the Comptroller of the Currency’s] San Antonio office, Mr. Ward pressured our bank to end our relationship with Power Finance Texas. Mr. Ward told me that, if Business Bank of Texas continued to provide [automated clearing house] services to Power Finance Texas and other small lenders, the bank would incur a significant reputational risk. Although I completely disagreed with this assessment, Mr. Ward left no doubt that the relationship would have to be ended. The pressure that was brought to bear on our bank by our regulator left us with no choice but to drop Power Finance Texas as a customer and close its accounts.

Norbert Michel, an expert in financial regulations at The Heritage Foundation and critic of Operation Choke Point, said it’s “very unusual” for bankers to publicly discuss problems with their regulator.

“So this statement is a very strong indictment of what’s going on behind the scenes,” he said.

The Daily Signal contacted the Office of the Comptroller of the Currency, but a spokesperson said the agency does not comment on open litigation. However, the spokesman did point to 2014 testimony by the agency’s deputy chief counsel, Daniel Stipano.

“As a general matter, the [Office of the Comptroller of the Currency] does not direct banks to open, close, or maintain individual accounts, or recommend or encourage banks to engage in the wholesale termination of categories of customer accounts,” Stipano said. “In rare cases where the bank cannot properly manage the risk presented by a customer, or a customer has engaged in suspected criminal or other illegal activity, we may order the bank through an enforcement action to terminate the customer’s account.”

In that testimony, Stipano also confirmed that “some of the official requests for information we received from [the Justice Department] during 2013 were related to Operation Choke Point.”

Reaching Beyond Payday Lenders

Payday lenders aren’t the only industry complaining that Operation Choke Point continues to target their businesses unfairly. Tom Hudgins, chief operating officer of Western Shamrock, an installment loan corporation based out of Texas, told The Daily Signal that his industry has felt the squeeze as well.

“Our funding sources continue to be squeezed and our banking relationships at local levels continue to be eliminated,” said Hudgins, who operates 300 locations in 19 different states. “It’s creating havoc.”

Hudgins said that within the installment lending industry, “there is some sentiment that there is a last-ditch effort to eliminate not just funding sources, but banking relationships to the traditional installment lending industry.”

In some cases, Hudgins said he’s maintained relationships with banks for over 20 years, “and suddenly, those banks decide not to do business with us because they view as that ‘reputational risk.’”

Installment loans have been around for longer than payday loans, and are repaid over time. They differ from payday loans because they are typically fully underwritten, require stringent verifications of customers’ ability to repay, and often span a much longer period of time.

Randy Dalton, CEO of Banner Finance, an installment loan business with 37 branch offices in four different states, said there’s been at least three instances in the past two years where he’s had to change banks as a result of terminations.

“One of our main lending institutions essentially cut us off from wanting to do business, and we had a relationship with them for over 50 years,” he said.

Losing a bank relationship, Dalton added, “puts us obviously in a tremendous scramble.”

“It makes it very difficult for a small business—which is what we are—to operate. It’s not only hurting us, it hurts our customers,” Dalton said. “Because all the sudden, we can’t be there for them when they have a financial crisis that comes about.”

Dalton agreed with the assessment that the current situation is “very urgent,” and said he’s operating in fear about what could come next.

Under a New Administration

Despite the uncertainties of the coming weeks, both payday and installment lenders told The Daily Signal they have a reason to be hopeful.

Although President-elect Donald Trump hasn’t commented on Operation Choke Point, Republicans in Congress have attempted on multiple occasions to dismantle the little talked about program.

Sens. Ted Cruz, R-Texas, and Mike Lee, R-Utah, introduced legislation aimed at unraveling Operation Choke Point, and the two are regular allies of Trump’s nominee for attorney general, Jeff Sessions.

An identical version of the senators’ bill passed the House of Representatives 250-169 in February with bipartisan support.

“The Trump administration hasn’t said very much about Operation Choke Point,” Heritage expert Michel said, “but that’s going to have change pretty soon.”

“These allegations suggest that unelected federal bureaucrats, from an executive agency, are determining who banks can’t do business with. If the president-elect is serious about letting bankers be bankers, he has to stop this behavior.”