Federal Agency Blames ‘Confusion’ for Choking Business Owners’ Access to Banks

Kelsey Bolar /

Federal regulators have backed away from pressuring banks to stop doing business with legal enterprises that the Obama administration labeled “high risk” — including selling guns, making payday loans, and trading in rare coins.

Late last month, the Federal Depositors Insurance Corporation told banks that it had removed a list of 30 examples of “high risk” activities from the agency’s website, stating its list had “led to misunderstandings.”

By “misunderstandings,” FDIC apparently meant that its guidance led to sudden decisions by banks across America to close accounts with customers that fell under any of the listed categories.

>>> Related: Meet Four Business Owners Squeezed by Operation Choke Point

If they didn’t close the accounts, bank officers thought, they could be subject to federal audits or other investigations.

FDIC spokesman Andrew Gray, in an interview this week with The Daily Signal, said:

The FDIC recognizes the confusion about the meaning and significance of these lists of examples of merchant categories, including the potential for the misperception that the merchant categories were specifically prohibited or discouraged.

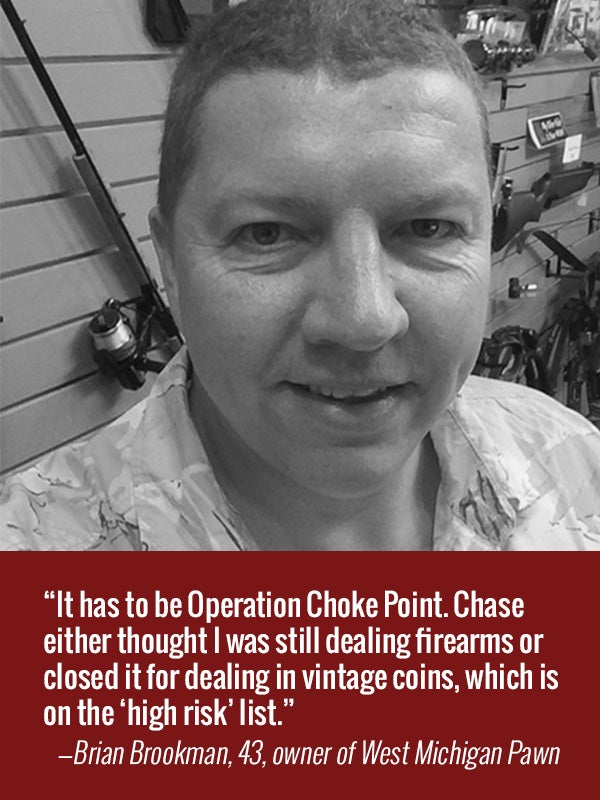

Despite FDIC moves to “clarify” its intent, federal financial regulatory agencies have not pulled out of a secretive Obama administration program dubbed Operation Choke Point. Those squeezed by the Justice Department-coordinated operation include business owners such as Brian Brookman, an Army veteran and former police officer.

Brookman, 43, owns a pawn shop in Grand Haven, Mich., where he also used to sell firearms. In June, after growing tired of more and more regulation, he decided to let his firearms license expire and focus on his pawn shop.

Brookman opened a business account for the shop last month at a local Chase Bank. Two weeks later, without explanation, he received a letter from Chase stating it was closing the account, he told The Daily Signal.

The Federal Depositors Insurance Corporation, with more than 7,000 employees, is responsible for regulating and auditing more than 4,500 banks. Besides insuring deposits, FDIC has the discretion in times of financial crisis to decide which banks get rescued by the government and which do not.

FDIC’s direction is taken seriously by financial institutions nationwide.

So in 2011 and again in 2012 when the agency identified the business categories that pose “elevated … legal, reputational, and compliance risks,” a report by a House committee found, it pressured banks to terminate relationships with customers — such as Brookman — in those kinds of businesses.

Featuring a range of both legal and illegal activities that President Obama’s Department of Justice finds objectionable, the “high risk” list was posted by the FDIC on its website:

The report by the House Oversight and Government Reform Committee concluded that the bank regulators were “acting in coordination with Operation Choke Point,” a program created by the Justice Department to force legally operating enterprises out of business by cutting them off from the financial services they need to survive.

By categorizing coin dealers, gun sellers, and short-term lenders as “high risk” — and equating them to explicitly illegal or offensive activities such as ponzi schemes, pornography, and racist materials — the FDIC as part of Operation Choke Point “effectively transformed this guidance into an implicit threat of federal investigation,” the House panel’s May 29 report concludes.

Earlier this summer, Oversight and Government Reform Chairman Darrell Issa, R-Calif., sent a letter to Martin J. Gruenberg, chairman of the FDIC, challenging the agency’s pressure on banks to terminate relationships with legal businesses.

Rep. Blaine Luetkemeyer, R-Mo., introduced a bill that seeks to end “overzealous and inappropriate use of regulatory and enforcement tools” — aimed at abolishing Choke Point. Luetkemeyer condemned the administration’s initiative:

In July 15 testimony before the House Financial Services Committee’s subcommittee on oversight and investigations, FDIC official Richard J. Osterman acknowledged that his agency “communicated and cooperated with DOJ staff involved in Operation Choke Point.”

Within two weeks of the hearing, FDIC-supervised banks received a letter from the agency announcing it was “clarifying” the guidance and removing lists of “high risk” businesses because they had “led to misunderstandings.”

But Alden Abbott, a senior legal fellow at The Heritage Foundation, challenged FDIC’s characterization that banks were confused about the purpose of its “high risk” lists.

“There is no confusion,” Abbott told The Daily Signal, adding:

By their very terms, the FDIC’s [guidance] plainly sought to discourage FDIC-supervised institutions from dealing with a large number of entirely lawful ‘high-risk’ merchant categories, including third-party payment processors, firearms sales companies, and payday loan companies, just to name a few. References in the FDIC’s 2011 release to ‘high-risk’ activity and in the 2012 letter to ‘elevated . . . legal, reputational, and compliance risks’ posed by firms in listed categories clearly warn [banks] against doing business with such firms.

The @FDICgov plainly sought to discourage banks from dealing with entirely lawful ‘high-risk’ merchants.

However, Abbott said he applauds the agency for recognizing “the error of its ways” and, in its July 28 letter to banks, withdrawing “that ill-advised guidance.”

Was the letter a direct response to criticism of the agency’s involvement in Operation Choke Point? Gray, the FDIC spokesman, said:

Clearly, the existence of the list was open to misinterpretation and criticized for a number of reasons. I wouldn’t pinpoint one issue that drove the decision; it was cumulative.

The FDIC’s intent, Gray added, was to “remove the focus from the specific merchant activities to the underlying supervisory policy that we will neither prohibit nor discourage banks that properly manage account relationships from providing service to any customer operating in compliance with applicable law.”

So is Operation Choke Point over? Far from it, says Abbott, who recently published a legal brief on the operation.

>>> Heritage Paper: ‘Choking Off’ Disfavored Businesses and Their Clients

Other federal financial regulatory agencies are believed to remain involved in the Justice Department-coordinated operation. Abbott said:

A government committed to the rule of law must treat all lawful businesses equally, and Choke Point sadly ignored that.

“Unless and until all of those agencies publicly and unequivocally act to discontinue singling out industry categories based on arbitrary government fiat, rather than proven fraudulent conduct, burdens on lawful but politically incorrect businesses will remain. A government committed to the rule of law must treat all lawful businesses equally under the law, and Operation Choke Point sadly has ignored that foundational principle of our constitutional republic.”

Until then, Brian Brookman and other Choke Point targets worry that the government will continue to limit their access to banking services, putting their livelihoods at stake.

Although Brookman was able to open an account for his pawn shop at another local bank, he recently got an email from PayPal saying the Internal Revenue Service has an issue with his account because of “new regulations.”