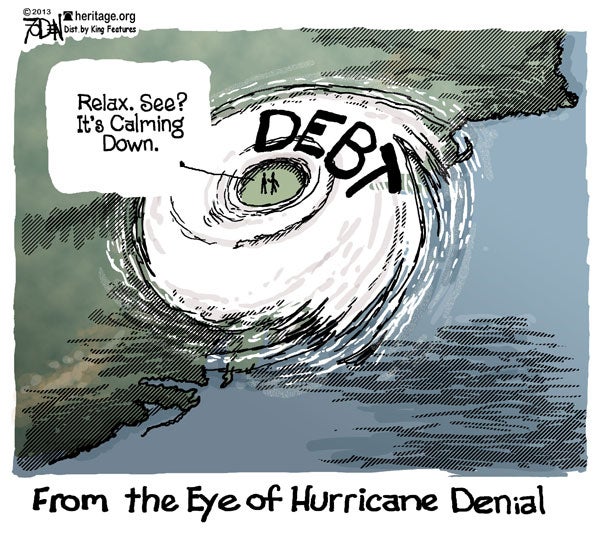

U.S. Debt Poses a Greater Barrier to Economic Opportunity Than Income Inequality

Rachel Greszler /

President Obama has made income inequality the forefront issue on his 2014 agenda. However, more government is not the solution to increasing economic opportunity in the United States.

More government has been the theme of the past decade and the hallmark of the Obama Administration. From the Medicare prescription drug benefit under President George W. Bush to nearly $1 trillion of economic stimulus to Obamacare, policymakers have sought to combat both individual and economy-wide problems with big-government solutions.

The most relevant result has been the massive rise in U.S. debt. From 2003 to 2013, the U.S. racked up more than $10 trillion in debt, bringing total debt from just under $7 trillion in 2003 to $17.4 trillion in 2013. U.S. debt amounts to $55,000 for every man, woman, and child living in the U.S., or $142,000 per household. Massive and growing deficits are projected to add to this burden, making it hard to imagine how the U.S. will ever be able to balance its books, much less pay down its debt.

But the interest payments alone will be enough to crush future generations. According to Heritage estimates using Census and Congressional Budget Office data, by 2023, annual interest payments on the U.S. debt will amount to $2,400 per person, or more than $6,000 per household. This is almost as much as what the median household pays in Social Security taxes each year.

These massive interest payments will provide no real benefit to future generations. Instead, they will effectively represent intergenerational transfers—parents and grandparents living beyond their means so that their children and grandchildren will be worse off. That’s not the American Dream.

When faced with a smaller economy, lower incomes, and massively higher taxes, young and future workers will find little comfort in a $10.10 minimum wage, forced unionism, or extended unemployment benefits. Before the President and policymakers attempt to adjust the rungs on America’s income ladder, they should first fix its broken rails.

If the U.S. does not curb its reckless spending and work toward reducing its massive debt, even young and future Americans who make it to the top of the income ladder could be worse off than those at the bottom today.