What Obama’s Campaign Group Won’t Tell You About Obamacare

Chris Jacobs /

Organizing for Action, President Obama’s campaign group, is out this morning with its first advertisement promoting Obamacare. The ad claims to tell the “facts” surrounding the law, but here’s what it doesn’t tell you:

Claim: “Free Preventive Care for 34 Million”

Fact: Obamacare forces insurers to cover preventive services without a co-payment, but just because some services now don’t have a co-payment doesn’t mean they’re “free.” Mandates like the one surrounding preventive care are raising health insurance premiums. Earlier this month, CBS News reported that “Obamacare may cost more than experts previously thought, according to a survey of 900 employers.” What’s more, the preventive services mandate also forces religious organizations to violate their deeply held beliefs and provide employees with contraceptive products they find morally objectionable.

Claim: “$150 Average Rebate in 2012”

Fact: This talking point refers to Obamacare’s medical-loss ratio provision, which imposes price controls on insurance companies, forcing them to pay rebates to consumers if they do not meet Obamacare’s arbitrary standards. The Kaiser Family Foundation reported last year that rebates would be issued to plans covering 3.4 million people, or only about 1 percent of the population. The Kaiser report admitted that the rebates “are not particularly large in many instances.” While candidate Obama promised that premiums would go down by $2,500 by the end of his first term, the average employer premium has actually gone up by $3,065—from $12,680 in 2008 to $15,745 in 2012, according to Kaiser data.

Claim: “Up to 50% of Small Business Insurance Covered”

Fact: The ad claims that Obamacare’s small business tax credit—which funds a portion of health insurance premiums—is having a major impact. But a May 2012 Government Accountability Office (GAO) report found that only about 170,000 small businesses claimed the Obamacare tax credit—far less than expectations of up to 4 million trumpeted by supporters. The report also makes clear that the credit’s complexity and bureaucracy discouraged small businesses from applying for the credit. Here’s what tax preparers quoted in the GAO report said about the tax credit:

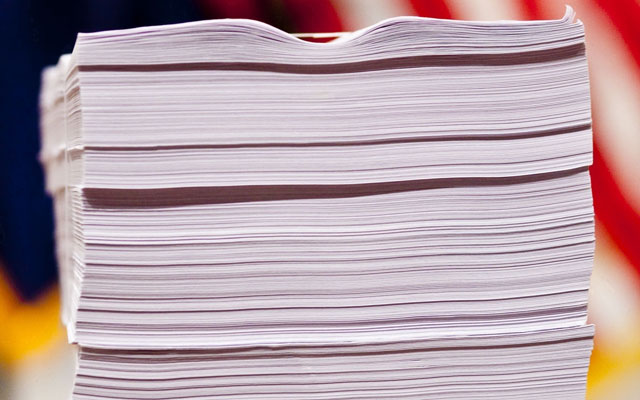

Any credit that needs a form that takes 25 lines and seven work sheets to build those 25 lines is too complicated.…

[Small business owners] are trying to run their businesses and operate and make a profit, and when you tell them they need to take two, three, four hours to gather this information, they just shake their head and say, “No, I’m not going to do it.”

In other words, bureaucracy, complexity, and regulations have stifled the small business tax credit—an apt metaphor for the law as a whole.