Treasury Employs Extraordinary Measures to Spend Beyond Debt Limit

Romina Boccia /

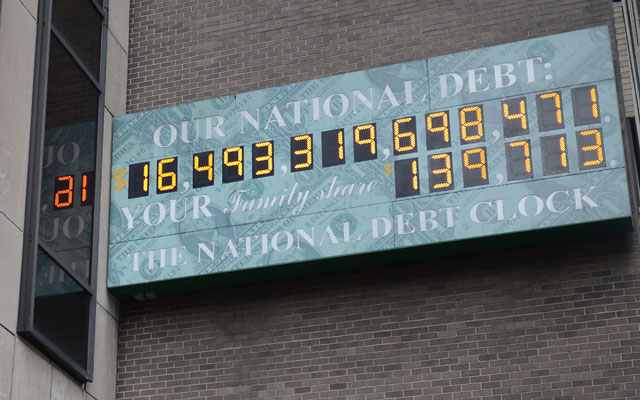

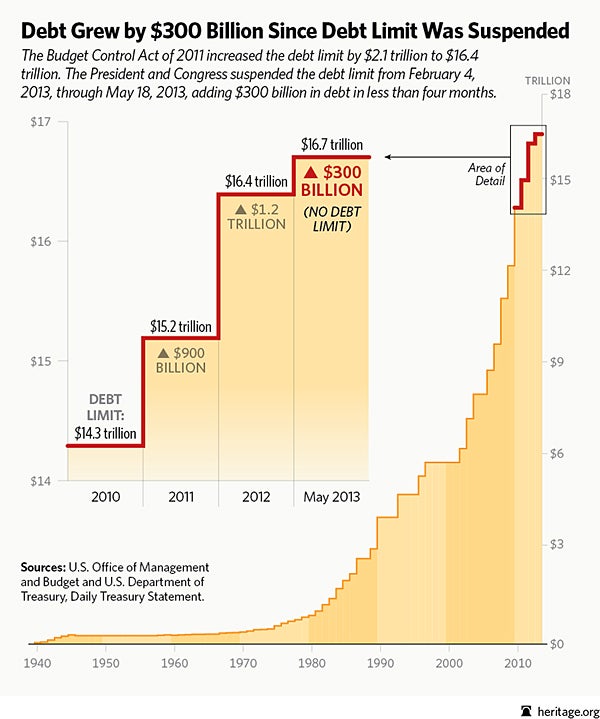

After hitting the debt limit on March 19, the Treasury Department under Secretary Jack Lew is now employing its toolset of “extraordinary measures” to continue deficit spending without legally breaching the debt limit.

It will provide about $260 billion in borrowing capacity, which should last beyond at least Labor Day, according to a letter from Secretary Lew.

These cash-management measures really aren’t extraordinary anymore; they have become a common occurrence in Washington. After hitting the debt limit in 2011, Treasury employed its extraordinary measures to create about $240 billion in additional borrowing capacity from May 16 through August 1. It tapped into the measures again just this January for $60 billion.

Below-normal revenue levels during the economic recession and $830 billion in stimulus spending drove deficits to trillion-dollar levels over the past four years and drove the debt up against its legal limit. But revenues are projected to exceed normal levels over the next decade. If lawmakers neglect to deal with the three major entitlement programs, they will drive the debt ever higher. Social Security, Medicare, and Medicaid already make up 45 percent of the budget, and they are growing at a rapid pace as the number of beneficiaries and associated costs keep going up.

Available extraordinary measures include:

- The Government Securities Investment Fund (G): $160 billion. The G Fund is part of the Federal Employees’ Retirement System Thrift Savings Plan. Treasury may take money in the fund and hold any interest payments to avoid a breach in the debt limit. Once the debt limit is raised, Treasury is required to pay back the full balance and lost interest.

- The Civil Service Retirement and Disability Fund (CSRDF): $74 billion. This fund pays benefits to retired and disabled civil service federal employees. Treasury may redeem certain investments in the fund and suspend new investments for a declared period of time and is required to pay back the balance with interest.

- The Postal Service Retiree Health Benefits Fund (PSRHBF): $5 billion. The U.S. Postal Service is required to prefund health benefits for its retirees in the PSRHBF. Treasury may apply the same tools to this fund as to the CSRDF.

- The Exchange Stabilization Fund: $23 billion. This fund, among other uses, buys and sells foreign currency for economic stabilization purposes involving adverse or unwelcome exchange rate movements. For example, it was used in 2011 to help alleviate a surge in the Japanese currency after a major earthquake. Treasury is not authorized to restore lost interest.

- State and local government series Treasury securities. These are securities the federal government may or may not issue to states and local entities to hold any cash proceeds from their issuance of bonds.

The purpose of the debt limit is to serve as a wake-up call to the President and Congress that spending is out of control. It’s an especially important mechanism because nearly two-thirds of federal spending is mandatory, meaning it grows on autopilot without regular congressional consideration.

Lawmakers should heed this wake-up call and not raise the debt limit without cutting spending and reforming entitlements. Ignoring our fiscal problems by raising the debt limit without cutting spending for too many years is what got us here in the first place. Instead, Congress should quickly and decisively put the budget on a path to balance, especially by making important and overdue changes to entitlements. Delay will only increase taxpayers’ debt burden even more.