IRS-Gate: The Potential Criminal Implications

John G. Malcolm / Hans von Spakovsky /

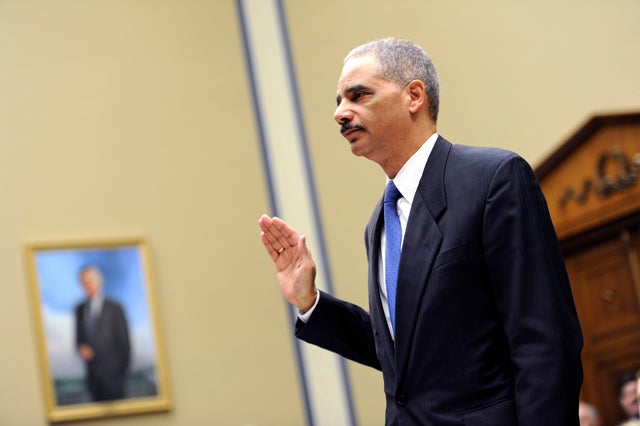

With the announcement by Attorney General Eric Holder of a criminal investigation of the IRS over the agency’s targeting of conservative Tea Party and other groups, a key question that has arisen is: What are the relevant federal criminal laws that might apply to the misconduct of IRS employees?

There are a number of provisions that are potentially applicable. It is important to keep in mind that the misconduct of IRS employees prevented numerous organizations from promptly obtaining the tax-exempt status to which they were entitled because they met the qualifications set out under the Internal Revenue Code—and some have still not received that clearance from the IRS.

The statutory provisions that may have been violated include:

- 26 U.S. Code § 7214: Offenses by officers and employees of the United States. This law applies to any officer or employee of the United States who “with intent to defeat the application of any provision of [the Internal Revenue Code] fails to perform any of the duties of his office or employment.” This is punishable by termination of his employment, a fine of not more than $250,000 (under the Alternative Fines Act, 18 U.S.C. § 3571), and imprisonment of not more than five years.

- 18 U.S. Code § 241: Conspiracy against rights. Section 241 makes it unlawful for two or more persons to “conspire to injure, oppress, threaten, or intimidate any person in…the free exercise or enjoyment of any right or privilege secured to him by the Constitution or laws of the United States.” Violations are punishable by imprisonment for up to 10 years and a $250,000 fine.

- 18 U.S. Code § 242: Deprivation of rights under color of law. Section 242, enacted as a post–Civil War statute, makes it unlawful for anyone acting under color of law, statute, ordinance, regulation, or custom to willfully deprive a person of any rights, privileges, or immunities secured or protected by the Constitution or laws of the United States. Violations are misdemeanors punishable by up to one year in prison and a $100,000 fine.

- 18 U.S. Code § 1001: Statements or entries generally. In his testimony before the House Judiciary Committee on May 15, Holder mentioned prosecutions for possible false statements. He was referring to Section 1001, which makes it a crime for anyone to make “any materially false, fictitious, or fraudulent statement or representation” on any matter within the jurisdiction of the executive, legislative, or judicial branches. So for example, if an IRS agent who engaged in targeting made a false statement about it to his supervisor, to someone else at the IRS, or to the inspector general—or later makes a false statement to the FBI agents and federal prosecutors who will now be interviewing IRS employees—he or she could be found guilty of violating this law. Additionally, former IRS Commissioner Douglas Shulman testified (but not under oath, so the perjury statute would not be applicable) in March 2012 before the House Appropriations Committee, where he supposedly denied that the IRS targeted conservative groups. If this was an intentional falsehood, he too could face criminal liability under this section. The potential penalty for violating this provision is five years’ imprisonment and a $250,000 fine.

There is no information in the report released by the Inspector General for Tax Administration at the Treasury Department that anyone in the White House had any knowledge of what the IRS was doing. But if such a connection were discovered during the Justice Department’s investigation, then 26 U.S.C. § 7217—which prohibits the President, the Vice President, or any of their employees (as well as cabinet secretaries) from “directly or indirectly” requesting that the IRS “conduct or terminate an audit or other investigation of any particular taxpayer”—could come into play. Violations of this provision are punishable by imprisonment for up to five years and a potential fine of $250,000.