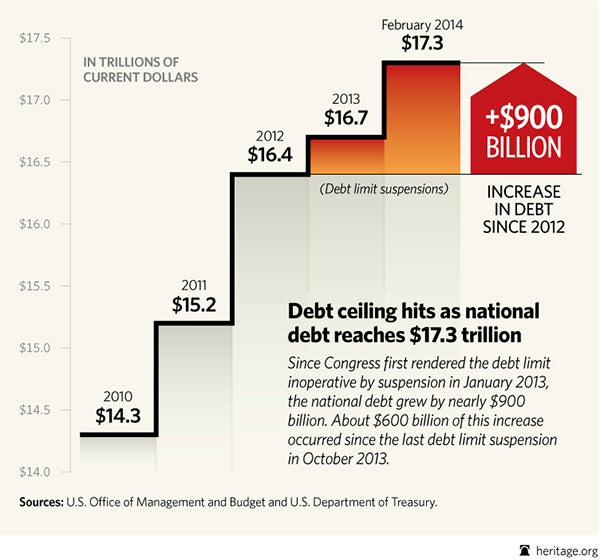

The U.S. national debt has reached nearly $17.3 trillion. When the Treasury’s blank-check borrowing authority expired at midnight last night, the U.S. officially hit its debt limit.

What most people failed to realize is that the U.S. government has operated since October with no debt limit in place.

>>> Check Out: Bam! We’re Already Hitting the Debt Ceiling Again

That’s right. Congress never raised the debt limit—it “suspended” it. Simply put, Congress made the debt limit go away until February 8, 2014.

This is not the first time that Congress has rendered the debt limit inoperative. It first suspended the debt limit in January 2013. Since then, the Treasury has borrowed nearly $900 billion.

Although the debt limit returned for a few months in May 2013, the Treasury continued issuing government debt almost as if nothing had happened—which is what will happen again this time.

The Treasury has a number of debt limit loopholes at its disposal that enable it to continue borrowing without legally breaching the debt ceiling. Also called “extraordinary measures,” these tools include borrowing from the federal employee retirement G Fund and the Civil Service Retirement and Disability Fund, among others.

When Congress fails to limit borrowing with the debt limit, the people’s representatives effectively abdicate their constitutional power to control borrowing—which encourages more spending and debt.

Approaching the debt limit is a very public and focused affair. It forces the American people and their representatives to confront the fact that the budget is unbalanced and that deficit spending adds to the already massive national debt.

It’s also an effective opportunity to shame Congress and the President for their reckless spending and borrowing, which is why congressional challengers often highlight an incumbent’s vote to increase the debt ceiling in election campaigns.

These features of the debt limit statute make it tough to vote for increasing the debt ceiling. America’s Founders recognized the benefit of being able to borrow when the need arose, especially in times of war. But they also recognized that out-of-control debt posed a great danger to the nation’s prosperity and sought to pay down the debt and limit it.

The debt limit serves as an important check on federal spending and borrowing. Congress is, yet again, confronted with the debt ceiling, and the Treasury’s leeway is projected to run out in late February.

A prudent Congress would put the budget on a path to balance in order to avoid a much worse fiscal crisis in the future—before deciding how much more to borrow. Importantly, Congress should put an actual limit on the debt—not a suspension that allows for unlimited and unaccountable borrowing.